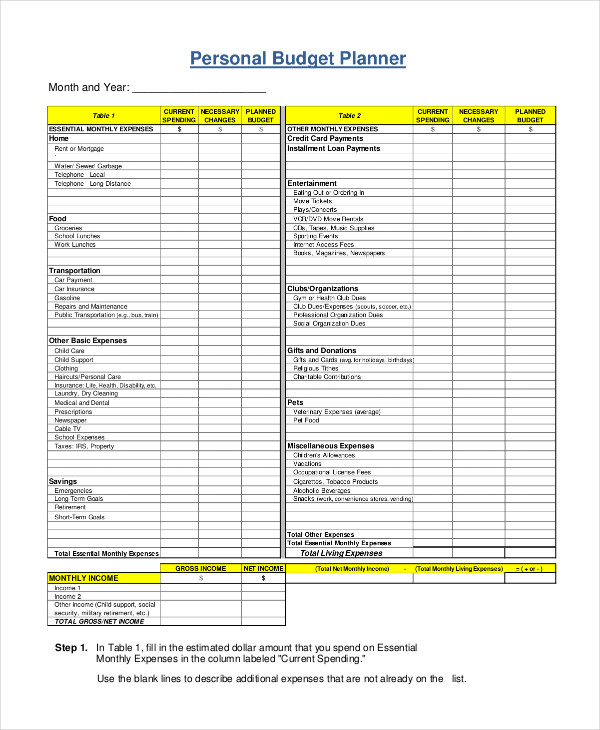

This document is highly beneficial for an employee who receives a semi-monthly paycheck. Budgeting is necessary as it enables you whether you have extra cash to spend on items that you may find difficult to afford. If your income changes from month to month, add up your total monthly deposits for the last 3 months and divide that number by 3 to get a baseline monthly. Within the four cells that contains ‘$0’, this amount is automatically calculated for the user based on the information that user enters within their budgeting template. A bi-weekly budget template is a helpful tool that will guide you in the right direction on managing your biweekly Paycheck. It allows to easily manage bi-weekly income, bills, and expenses as well. It’s important that you set up a plan for each paycheck to make sure your bills get paid. Here is the simple and empty worksheet of the bi-weekly budget plan also available in Excel for free. Writing a biweekly budget is the first step to creating financial stability. The first step to create your monthly budget is simple: Enter your income. You can create your budget in a spreadsheet, on a piece of paper, or the best waywith EveryDollar. This cell is meant to be selected by the user. Step 5: Write your first biweekly budget. When you create a monthly budget, you tell your money where to go so you’re never again left wondering where it went. This bi-weekly budget template is a helpful tool for tracking and managing your expenses on a two-week period. Within the cell that says ‘Every Month’, there is a small grey drop-down button to the right of the words ‘Every Month’.

The diagram is a screenshot of the “Balancing Your Budget” table within the budgeting template.

0 kommentar(er)

0 kommentar(er)